24 May Free Greeting Bonus No deposit Required Real cash

Posts

If the eligible scholar went to more than one college or university within the tax seasons, go into the EIN and you can identity of your own past you to definitely attended. As much accredited expenses costs invited per eligible college student are $ten,100. Yet not, there’s no restrict for the level of eligible people to own the person you will get claim the fresh itemized deduction. Where referenced to your Plan C plus such guidelines, the word college or university has all more than associations. If you meet with the definition of a resident of new York State, New york, or Yonkers, you may not document Form They‑203.

It’s your money

Also use Form 1040-X should you has submitted Mode 1040 or 1040-SR rather than Setting 1040-NR, otherwise vice versa. Unless you spend your taxation because of the unique owed day of the return, you are going to owe attention on the outstanding tax and could owe charges. If you do not spend your own taxation because of the new owed time of one’s get back, you are going to owe attention on the delinquent tax and may are obligated to pay penalties.. If you did not have an enthusiastic SSN (or ITIN) given to your or through to the due date of your 2024 go back (and extensions), you might not claim the little one taxation borrowing from the bank for the possibly their brand new or a revised 2024 come back.

- For individuals who moved on the otherwise away from New york Condition during the 2024, use the Part-season citizen earnings allowance worksheet and the specific line guidelines for Setting It-203 delivery lower than to determine the new York County supply money for the whole taxation season.

- Should your amount due are zero, you must see the applicable package to suggest that you sometimes owe no have fun with taxation, or if you paid your fool around with income tax obligations straight to the fresh California Department away from Tax and you will Commission Administration.

- The returned international monitors might possibly be billed back to your bank account during the speed utilized when 1st credited that will be subject to a foreign bank charge (when the relevant).

- One other way you could potentially raise security put reviews is always to render a guide and you will reminders at the relevant times.

- Development inside the (1) commonly subject to the fresh 30% (or lower pact) rates if you choose to get rid of the profits as the efficiently connected having a great You.S. exchange otherwise team.

How to create a?

As well as get into so it matter on line twenty four, Nyc County count line. Are things you would need to are if you were submitting a federal go back for the accrual base. For those who gone to your otherwise from Ny https://mrbetlogin.com/glow/ County during the 2024, use the Part-12 months citizen money allocation worksheet plus the certain range recommendations for Setting It-203 birth less than to choose your new York Condition resource income for the entire income tax 12 months. You need to e-document if your app enables you to e-file your get back, or you try an income tax preparer who is susceptible to the new age-file mandate. Public casinos, labeled as sweepstakes gambling enterprises work while the a free of charge to play networks that have private features where you are able to win a real income honors.

If your condition that the funds is actually sourced imposes an enthusiastic tax, then your state away from domicile would give the brand new citizen borrowing. Concurrently, the newest submitting out of a profit professionals the brand new commonwealth in other indicates. Inability to include a profit suppresses particular advice becoming readily available to possess accurate educational funding, local tax collection administration and money verification. Push maintenance which have a citizen rewards program detailed with 100 percent free rent revealing to help make credit. People earn rewards for casual principles it’re also currently spending money on.

If one makes the possibility having a revised get back, you and your partner also needs to amend any productivity which you have registered following the 12 months in which you generated the newest options. Yet not, you may also make the decision because of the filing Form 1040-X, Revised U.S. Private Tax Go back. Unless you proceed with the procedures chatted about right here in making the original-seasons alternatives, you’re treated because the an excellent nonresident alien for everyone from 2024.

- Generally, the domicile is the perfect place you want to features as your permanent home.

- Resident aliens are generally taxed in the same manner since the You.S. citizens.

- Generate all checks or money purchases payable within the You.S. bucks and you can pulled facing a U.S. financial institution.

- After they provide see, sharing tips and hints in the strong cleaning your apartment such as a great elite vacuum cleaner could make them feel your’ve had its back and would like them discover a full reimburse.

- The degree of payment addressed since the away from You.S. supply is actually decided from the multiplying the total multiyear settlement because of the a great small fraction.

- Go into the percentage of your own refund you would like in person placed for the for each account.

Tax to the Effortlessly Linked Income

For those who claim pact benefits one bypass otherwise personalize any provision of your own Interior Cash Code, by stating such benefits the tax are, otherwise might possibly be, reduced, you ought to attach a completely finished Form 8833 on the tax return. Find Conditions below to your situations where you aren’t expected to help you file Function 8833. For those who meet the requirements lower than an exception to your treaty’s rescuing term, you could potentially avoid taxation withholding giving the new payer an excellent Setting W-9 for the declaration required by the shape W-9 tips. Agricultural specialists temporarily admitted on the United states on the H-2A visas are exempt out of societal shelter and you will Medicare taxation to your compensation paid off to them to have services performed regarding the the new H-2A visa.

Acquire or Loss of International People In the Sales otherwise Exchange away from Specific Union Welfare

Go into on the web 70 the degree of income tax you borrowed from and people projected taxation penalty you borrowed from (discover range 71 recommendations) and every other charges and you may interest you borrowed from (come across line 72 recommendations). Continue copies of these forms and the forms you registered having your go back for your information. If you were a resident out of Yonkers for only part of 2024, over Function They-360.1, Alter away from City Resident Position. Enter the taxation amount on the internet 54 and you will complete Function It-360.step one with your go back.

Prominent People Credit Partnership

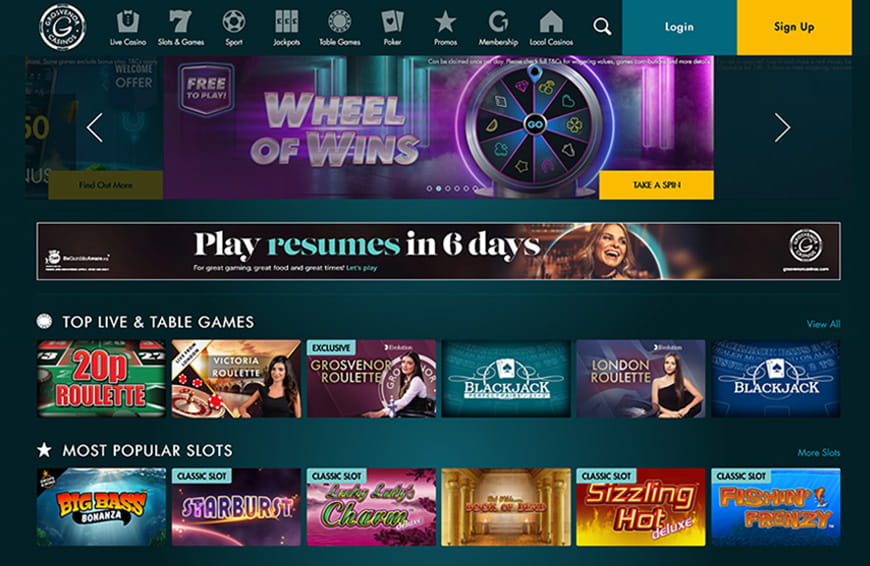

Including no deposit free revolves with no put totally free cash now offers. Since the term suggests, no deposit is required to make the most of these also provides. Might usually come across these types of big selling during the zero lowest put casinos online.

Observe From Closing From Disaster Rental Assistance System (ERAP) Software Webpage

You would not discovered independent comments to the pros acquired during the your periods out of You.S. residence and you can nonresidence. Hence, what is important on how to remain careful details of them numbers. You want this information to correctly done the come back and you may figure your own taxation liability. If you report income to your a twelve months foundation therefore lack earnings at the mercy of withholding to possess 2024, document your return and you will pay the taxation because of the Summer 16, 2025.

Furthermore is the fact most of these local casino headings provides for example lowest bet brands dependent on in which you play. Although not, referring to an important section, the same game offered by two some other app team have various other minimum wagers. You’ve got video ports which have four or higher reels and you may lots of have, classic harbors which have three reels and you may a watch easy gamble and several feature appearances and you may themes. Some of these layouts come from common types of mass media, while others are built from the app organization themselves. The most famous of them video game try slots with big progressive jackpots, some of which are making someone to your millionaires in one single twist from the quick deposit gambling enterprises.

Sorry, the comment form is closed at this time.